Understanding Amazon’s Tightened VAT Policies in the UK: A Guide for Sellers

Table of Contents

Introduction

Amazon has updated its UK VAT policy to improve tax compliance and adapt to changing regulations affecting domestic and international sellers on its platform. This strategic innovation aims to ensure the smooth running of the e-commerce sector, significantly contributing to the UK economy and setting a new standard for transparency in online shopping. The changes tighten the documentation and reporting of sellers to ensure a level playing field and simplify the VAT administration. This action exemplifies Amazon’s dedication to maintaining fair and compliant markets, emphasizing the significance of rigorous tax compliance for the platform’s sustained success in the digital era.

Understanding VAT and Amazon’s Role

What is VAT?

VAT is a consumption tax levied on a product whenever value is added at each stage of the supply chain from production to the point of sale. The VAT the user pays is calculated from the product’s price, from which the material costs used in the product, which have already been taxed, have been deducted.

Amazon’s VAT Obligations in the UK

As an online marketplace, Amazon is responsible for VAT compliance, guaranteeing that all transactions on its platform adhere to UK tax regulations. This means collecting VAT on sales, reporting it to the authorities and creating a framework for sellers to manage their VAT obligations.

Amazon’s New VAT Policies

Amazon’s revised VAT policies in the UK are designed to tighten compliance and ensure that all sellers meet their tax obligations. The changes include:

Increased Documentation:

Sellers must provide more comprehensive documentation to prove VAT compliance.

Automatic VAT Collection:

For certain transactions, Amazon will automatically collect and remit VAT to simplify compliance for sellers.

The decision to implement these changes was driven by the need to simplify VAT management for sellers and to comply with UK tax legislation, ensuring a fair and competitive marketplace.

Impact on Sellers

Amazon’s recent VAT policy adjustments in the UK have significant implications for both domestic and international sellers, aimed at enhancing compliance and simplifying operations. Here’s a condensed overview of these impacts:

Effects on Domestic Sellers

Increased Administrative Burden:

Sellers need more paperwork and compliance checks, increasing operational demands and potentially diverting resources from other business areas.

Potential for Streamlined Operations:

Despite initial challenges, more precise guidelines could lead to more efficient VAT management, reducing errors and freeing up resources for growth.

Effects on International Sellers

Requirement for UK VAT Registration:

Sellers outside the UK must now register for VAT, adding complexity but aligning with global tax fairness efforts.

Challenges in Compliance:

Navigating UK VAT laws may require external advice or new software, posing challenges but essential for market access and success.

How to Comply with the New VAT Policies

Compliance with Amazon’s updated VAT policies requires understanding and action from sellers. Here are steps to ensure compliance:

Review Updated Policies:

Familiarize yourself with the detailed policy changes on Amazon’s Seller Central.

Prepare Necessary Documentation:

Ensure you have all required documents, such as VAT registration numbers and proof of business status.

Use Amazon’s VAT Calculation Services:

Consider enrolling in services Amazon offers to automate some of the VAT processes.

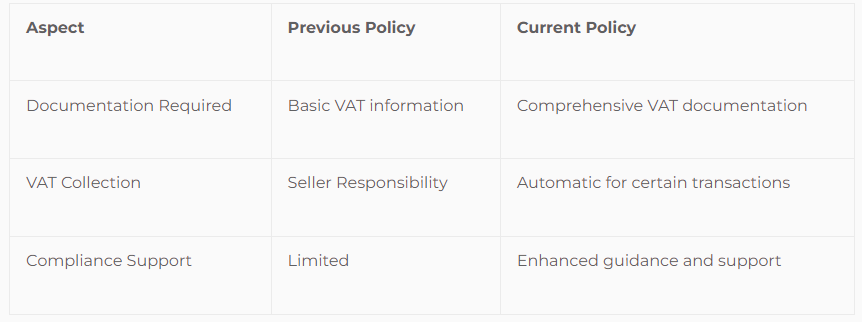

Comparison Table: Previous vs. Current VAT Policies

Conclusion

Amazon’s recent VAT policy revision in the UK has introduced increased administrative responsibilities for sellers but also offers the potential for a more streamlined and efficient operational framework. While sellers must adapt to these changes by maintaining detailed records and adhering to compliance checks, Amazon provides comprehensive resources to support them in this transition. The aim is to reduce errors and simplify VAT calculations, ultimately benefiting sellers in the long run. Adapting to these changes is crucial for compliance and demonstrating professionalism and commitment to customers and partners.

In conclusion, while Amazon’s updated VAT policies present initial challenges, proactive sellers who leverage available resources can navigate the complexities and improve operational efficiency. Embracing these changes is essential for a successful business venture on Amazon’s UK platform.

FAQS

Small sellers may face an increased administrative burden but can benefit from Amazon’s automated processes and support.

No, international sellers targeting the UK must comply with the new VAT policies.

Amazon provides various resources, including detailed guides, webinars, and a dedicated support team through Seller Central. These resources are designed to help sellers understand and navigate the new VAT requirements effectively.

Yes, the new VAT policies may influence product pricing. Sellers might need to adjust their prices to account for the VAT they must charge and remit, primarily if they register for VAT in the UK for the first time. Sellers need to consider how these adjustments affect their competitiveness in the marketplace.

Share: